With escalating regulatory requirements, such as the Sustainable Finance Disclosure Regulation (SDR/SFDR), managers must now disclose ESG data for both corporate and investee levels—data that has often remained out of the public eye until now. These demands call for a clear, cohesive articulation of ESG strategies and progress, ensuring compliance while strengthening investor confidence.

At Fin International, we have been at the forefront of helping clients craft their ESG and Responsible Investing narratives since 2018.

Our comprehensive approach addresses the five ways we can help you prepare your brand for SDR/SFDR, ensuring your ESG story aligns with both regulatory expectations and market demands.

Through these collaborations below, we have empowered our clients to develop proprietary ESG propositions, from naming and narrative to imagery and collateral. If you want to develop a clear and proven articulation of your sustainability directives and actions that’s on brand, please get in touch for a chat by calling Eliza on +44 (0)7771 520193 or emailing e.mould@fininternational.com

Below are examples of client success stories. Others not mentioned include our work for Apex Group, CVC, Amundi, Findlay Park, and Insight Investment.

1. Bringing To Life Your Sustainability Vision and Narrative

Janus Henderson

With over $250 billion AUM* partially invested in Article 8 funds and a new Article 9 fund, many of their clients, prospects and staff wanted to know where Janus Henderson stood on ESG and investing sustainability.

Our brief was to investigate and create their corporate and product sustainability messaging while developing narratives to communicate it to clients and prospects.

We assimilated relevant materials and conducted interviews with key internal stakeholders focused on ESG and sustainability, including their Head of ESG, Head of Governance, and Head of D&I.

*As of May 2023

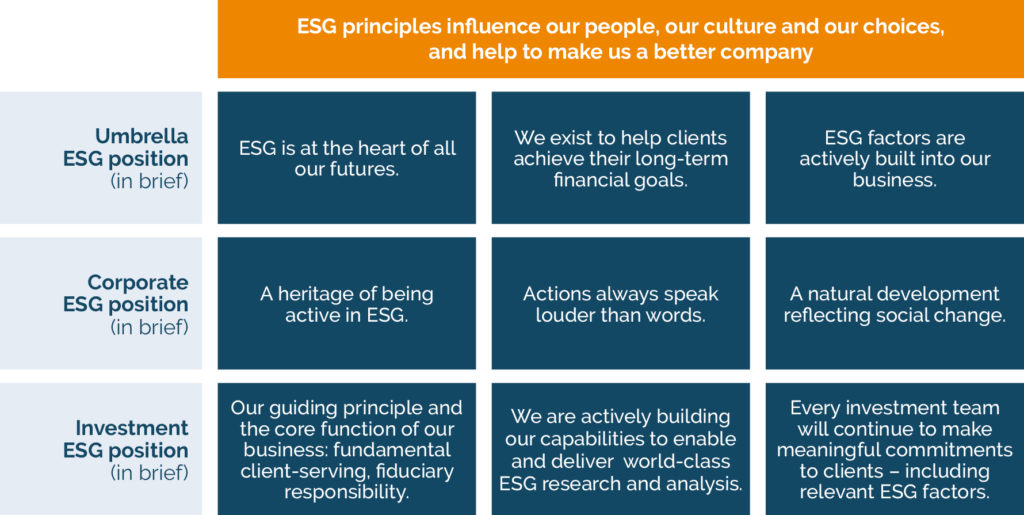

A structured overview of ESG principles guiding our people, culture, and choices, showcasing umbrella, corporate, and investment positions to support long-term financial goals and social responsibility.

To learn more about Janus Henderson ESG:

https://www.janushenderson.com/en-gb/investor/who-we-are/brighter-future-project/responsibility/

NatWest Markets – ‘Facilitating Clarity’

NatWest Markets is the investment banking arm of NatWest Group based in the United Kingdom and have been active for many years in the Sustainable Finance sector.

Our brief was to develop a proposition and messaging for NatWest Markets Sustainable Finance (SF) towards Corporates and Financial Institutions looking to build their sustainability strategies.

A core messaging proposition of ‘Facilitating Clarity’ answered concerns from clients as to understand sustainability within their own corporate goals.

We developed four key tenets of the offer and from the core proposition from which we built separate narratives to Corporates and Financial Institutions.

Simplifying complexity: Collaborating to deliver clarity and achieve your business and investment sustainability goals.

NatWest Markets Sustainable Finance: A focused, pragmatic, inspiring, and challenging approach to exceeding clients’ sustainability needs for today and tomorrow.

2. Refresh Your Visual Identity

Fidelity International

Fidelity International Ltd provides investment management services including mutual funds, pension management and fund platforms to private and institutional investors. Parent company Fidelity has $728.6 billion AUM*.

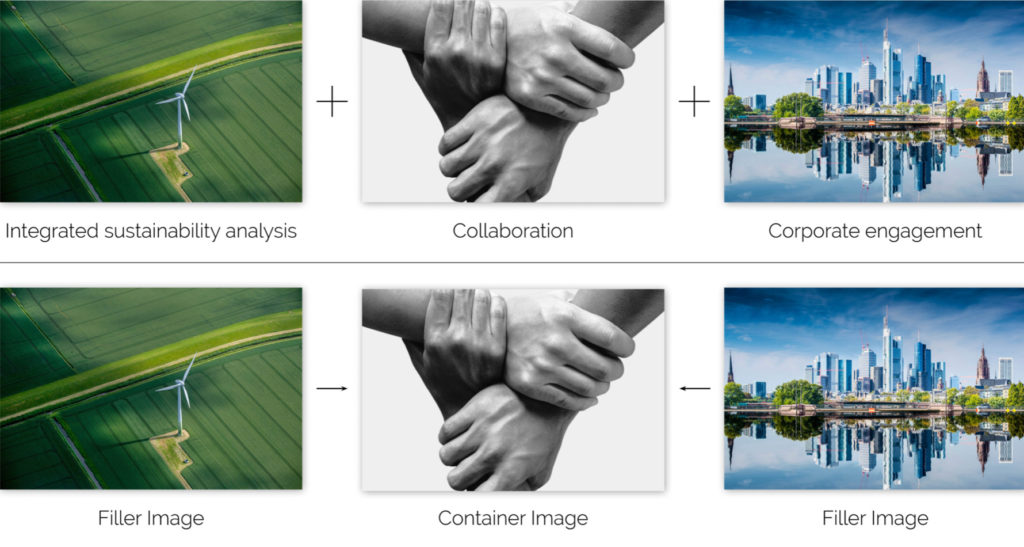

Our brief was to visually represent the three pillars of the Sustainable Funds Family framework, elevating the S and the G in ESG, focusing on diversity and collaboration.

We produced a system that combined several images within a fluid and flexible system that could take off-the-shelf assets and turn them into something distinctive and ownable, that could be as sophisticated, or main stream, as our client’s brief demanded.

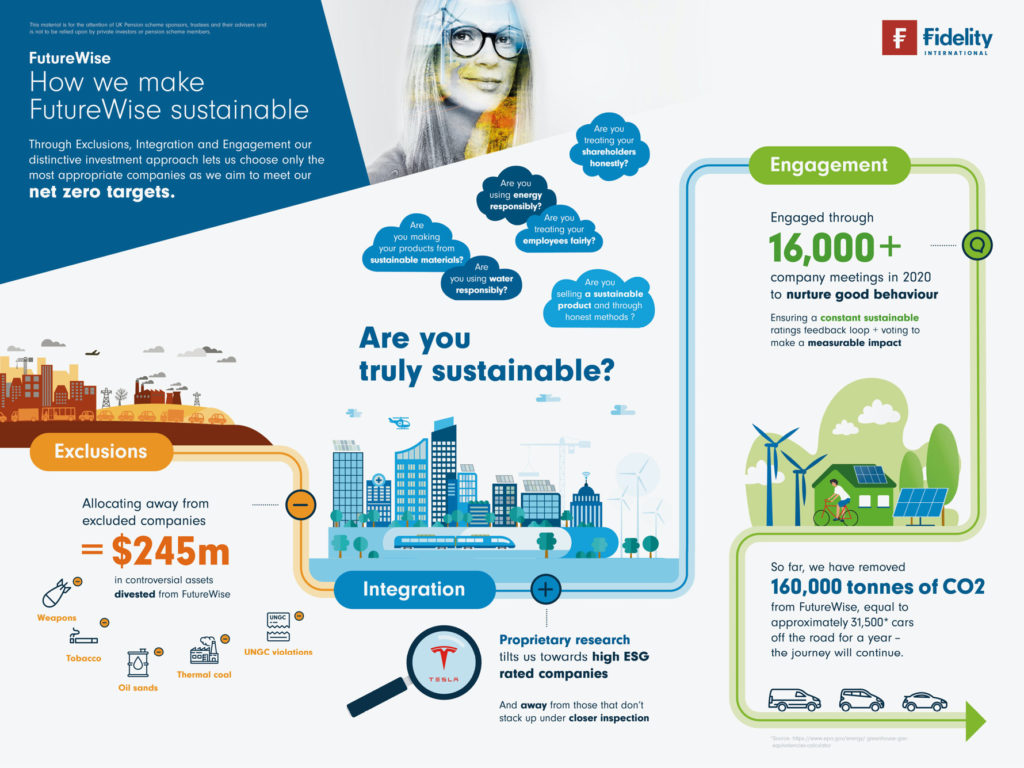

We were then briefed by Fidelity International to analyse their existing workplace pension materials, FutureWise, and put a bit of” zing” into the employee and member engagement experience, linking the visual styling of the collateral to our work for the Sustainable Funds Family. Please click on the link below to see more of this project.

*As of May 2023

Fidelity Sustainable Investing

Fidelity’s ESG framework focusing on integration into fund management, direct engagement with companies, and collaboration with investors to drive sustainability.

Illustration of ESG integration: combining sustainability analysis, collaboration, and corporate engagement to support sustainable growth and responsibility.

Fidelity’s commitment to sustainable investing showcased through brochures, internal publications, and an online platform, highlighting innovative strategies and ESG integration.

To learn more about our work for the Sustainable Funds Family, please click on this link: https://www.fininternational.com/projects/fidelity-international-sustainable-funds-family/

Fidelity FutureWise ESG investing story

Fidelity’s FutureWise sustainability strategy: combining exclusions, integration, and engagement to divest from controversial assets, engage with companies, and reduce carbon emissions in line with net-zero goals.

To learn more about our work for Fidelity International’s FutureWise workplace pensions please click on this link: https://www.fininternational.com/projects/fidelity-futurewise

3. Reposition Products

CANDRIAM

Following the state intervention into the Belgium Bank, Dexia, a decision was taken to spin out the asset management arm as a stand-alone offer.

The challenge

As a part of Dexia, the successful asset management team had placed a low focus on marketing. This new need to present its offer to the market as an individual company required an entirely new identity.

Fin was briefed by Dexia Asset Management to define a new name and explore the brand positioning.

The process

First, we undertook an extensive and European-wide insight phase to build a deep understanding of the company in its current form. We carried out interviews with both internal and external stakeholders. With all of this research in place, the debate began to define the future Dexia AM offer.

In order to bring out a broader range of insight (as well as deeper engagement with a new brand), we circulated an online questionnaire among all Dexia AM staff.

We explored the global ‘brandscape’ of competitor brand positioning, taking in Dexia’s peer group of managers. This research was rapidly distilled into a number of ‘top-level findings’.

This process culminated in the generation of a ‘straw-man’ brand positioning and brand values, which were then shared and debated within an senior management committee workshop, structured and facilitated by Fin.

4. Update your investor collateral, video and website

Brooks Macdonald

Brooks Macdonald Group plc provides leading investment management services with discretionary Funds under Management of £16.2 billion*.

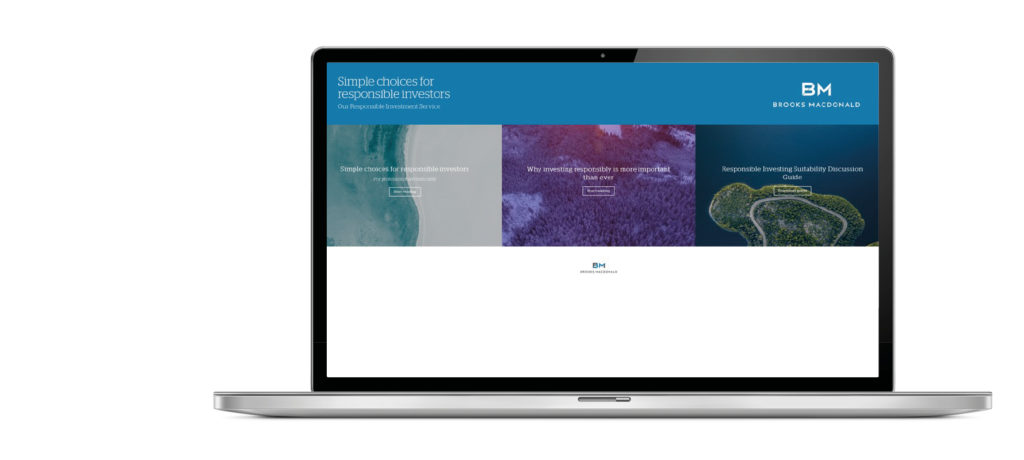

We were briefed by Brooks Macdonald Responsible Investment Services (RIS) to develop its core messaging to relevant target markets (B2B and B2C) across their Advance and Avoid strategies and to create a visual identity for RIS client engagement.

*As of December 2022

Brooks Macdonald: Simple choices for responsible investors, featuring sustainable investment services and resources to support ethical financial decisions.

Brooks Macdonald responsible investment resources: digital brochures, white papers, and sales aids designed to guide advisers and investors towards sustainable and ethical investment choices.

To learn more about Brooks Macdonald RSI – https://www.brooksmacdonald.com/investment-management/services/responsible-investment-service

Apex X WaterAid

Simplifying the complex through video for APEX’s LinkedIn Campaign

Clients often ask if can we take their complex and abstract product proposition and turn it into an engaging and educational campaign piece, punching home the key features without it being too long and onerous on the audience.

Our answer is “yes”. Fin’s focus on the investment industry over the past 30 years means we know what’s what.

An engaging approach we consider is a short, punchy, introductory video. Through creative story-telling we present the key points of your complex product or service, as seen by some of our success stories below.

Please take a look and get in touch to further discuss how to simplify the complex.

Apex Group

A snappy ‘sting’ video to announce their support for WaterAid on LinkedIn. Running time of 15 seconds.

5. Elevating Transparency in Sustainable Reporting

Squircle

Private market investors, especially in the realm of fund reporting, require more attention than most. These investors take on considerable risks, locking in their investments for five or more years, and must rely on the trustworthiness of owners and managers, rather than the more transparent, data-driven insights provided by brokers and public markets. With increasing liquidity constraints facing Limited Partners (LPs), General Partners (GPs) are actively searching for ways to nurture and strengthen their relationships through more detailed and engaging Fund Performance reports.

In collaboration with Squircle, we have developed comprehensive reporting solutions, including ESG Reports, Investment Reports, and Fund Performance reports, all designed to cater to the unique needs of private market investors. Despite the availability of various guidelines and regulatory frameworks dictating the content of these reports, their final presentation often lacks creativity, appearing dry, overly functional, and, at times, subpar compared to the high-quality information contained within.

This opens up a significant opportunity to improve investor reporting by producing well-branded, clear, and accessible documents that go beyond the functional and resonate with the values and expectations of both GPs and LPs. Well-crafted investment reports, for example, can enhance transparency, build trust, and support long-term investment relationships, by demonstrating a clear commitment to ESG principles and financial stewardship.

At Fin, we work with our clients to create fresh, customised, and branded templates for fund reporting. Whether it’s ESG reports, financial performance reports, or investment summaries, our work ensures the reporting process is tailored to your internal resources, streamlining production and enhancing the overall quality of your communications. Our goal is to create reports that not only provide vital information, but also reinforce the values and goals that matter most to your LPs and GPs, building stronger relationships and demonstrating care and commitment through exceptional design and branding in private equity reporting.

SCap Investments SCSp portfolio highlights: Year-end reviews and diverse project showcases spanning retail, hospitality, and marine industries.

SQuircle Capital’s 2023 ESG Annual Report: A detailed look at their structured investment strategies and impactful transformation efforts.

If you want to develop a clear and proven articulation for SDR/SFDR philosophy and actions that’s on brand, please get in touch for a chat by calling Eliza on +44 (0)7771 520193 or emailing e.mould@fininternational.com